Oct 2024 - A Comeback Story?

I apologize for being MIA for the past couple of months. I have been insurmountably busy in my life.

But hey, you know that classic Green Day song? September has ended, I am back. Time for a run down of the most exciting developments for my portfolio in the month. I have likewise submitted catch-up journal entry’s for the months that I have missed, containing performance developments and dividend incomes.

Moves

No active moves were made this month.

Performance

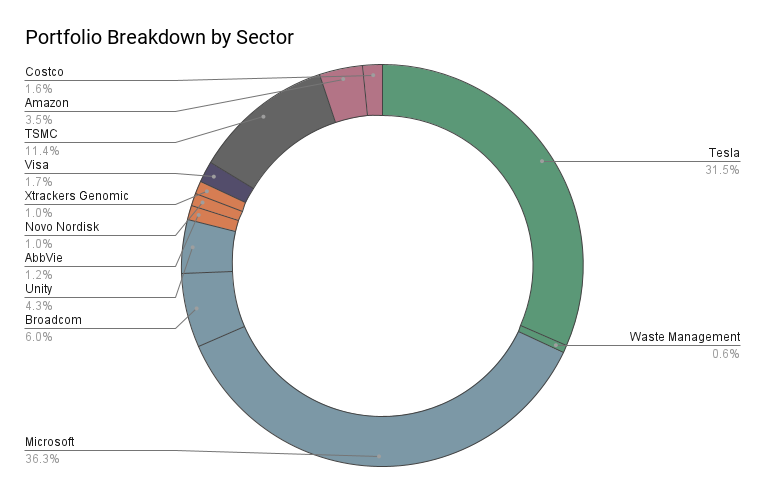

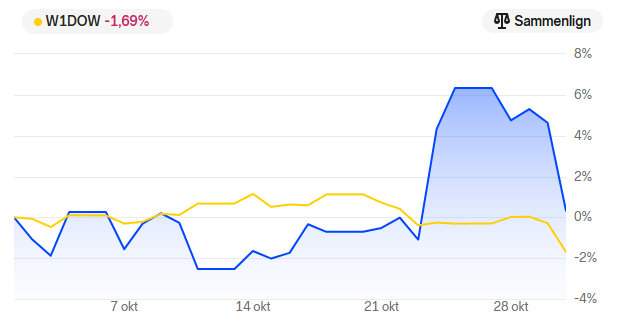

My portfolio value increased by 0.32%, or was nearly flat in the month of September, outperforming the Dow Jones World Index down 1.69% in the same period.

Dividend overview

| Name (Ticker) | Received | Amount (USD) |

| Broadcom (AVGO) | Oct 1st | $30.76 |

| Taiwan Semiconductor Manufacturing Company (TSM) | Oct 10th | $61.78 |

| Total | Oct 2024 | $92.54 |

I received a total of $92.54 in dividends before taxes for September 2024, down 38.06% compared to the same month last year at $149.40.

Commentary & Review

Tesla enters the next stage

On October 10th or 10/10 the long anticipated Tesla (TSLA) Robotaxi event finally took place. Originally delayed from 8/8 (August 8th) this event came with very high expectations - that were only partly met. The public stream went only for a little over 30 minutes following quite significant time delay, due to a personal emergency on site. Had I stayed awake all night to watch the stream, as originally planned, I would have likely have come away disappointed as well. Luckily, I had decided against it last-minute and instead planned for an early morning.

I woke up to a few very exciting announcements, comments and a very digestible (short) recording of the stream. Here is what was unveiled:

The Tesla Robotaxi dubbed “Cybercab” - of which now around 20 prototypes now exist. Featuring a sleek, futuristic design, no steering wheel or pedals, a giant center console, 2 seats and a large cargo space + wireless charging.

Tesla had 50 autonomous vehicles running unsupevised FSD, deployed at the event, utilizing its existing fleet of vehicles (Y & 3 vehicles) in addition to the 20 Cybercabs.

The surprise of the evening was the unveiling of an autonomous bus: the Robovan, which looks even more futuristic and carries up 20 passengers. This however, is clearly product concept for further out in the future.

Tesla expects to carry out paid autonomous rides starting in Texas, followed by California, using its existing fleet vehicles in 2025 and the Robotaxi and have the Cybercab on the road before 2027.

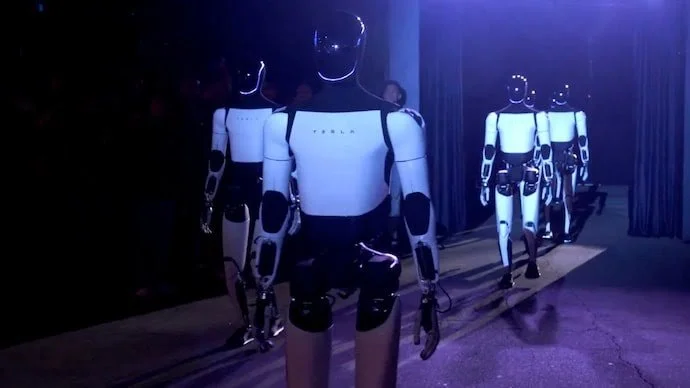

Finally they brought out an army of humanoid robots, the Tesla Optimus bot, with the announcement that these are now capable of “anything” - including dog-walking, babysitting, serving drinks and more.

What had disappointed investors (the stock dropped more than 10% the following day) was a lack of concrete details. No dates where announced for the roll out, no regulatory approval had been obtained etc. I was content however, with Tesla pulling off live demos (they offered hundreds of rides at the event, that have been recorded by attendees) with success in cars without a manual controls. I was likewise impressed with the design of the Robotaxi vehicle and agree with the decision to make it a 2-seater as this covers about 80% of all drives. It was also nice to get an estimation of cost per mile - being $0.2 for the 2-seater and $0.05-0.10 for the 20-seater.

What was disappointing to me however, and even very strange was that the humanoid robots at the event, were clearly being teleoperated by humans. Each robot had distinct human voices and reacted far too quickly for an AI model to realistically have processed and properly responded on its own. This made for some viral clips on social media of Optimus bot bartenders, dancers etc. but really came off as gimmicky and slightly misleading in the end - amplified by Tesla’s unwillingness to be upfront about what was happening behind the scenes.

If you enjoy this post, please consider subscribing at the bottom of the page to receive new posts directly in your inbox. 1-2 times per month. Completely free! Thanks to Stock Events for sponsoring this blog.

A few moments later…

Shortly following the landmark Tesla event, just two days later, Musk took to his privately owned company SpaceX to pull off the most incredible feat of rocket engineering I have ever witnessed: Grabbing the 70 meter tall Super Heavy Booster from the Starship rocket with two mechanical chopsticks. On its first attempt. Unreal.

2 week after this, Tesla reported Q3 earnings. The stock shot up, and continued to do so throughout the day following. The report itself was strong. Energy has crossed 30% margins for the first time and is starting to take weight in overall earnings. Auto margins are starting to come back up too, despite lower prices, making up an overall margin of 10.8%. Even the Cybertruck production line is now turning a profit. The average price for producing a Tesla has now come down to $35.000 - which is incredible when you consider that the S/X and Cybertruck are in that mix too, with skews above $100.000.

Services are doing well too, boosted by the roll out of ASS (Actually Smart Summon), which allowed FSD enabled cars to pull out of parking spots and navigate to its driver on its own. These added features allow Tesla to recognize more of the revenue coming in from FSD. ASS has now also been approved for Europe.

Tesla guides for 515.000 vehicle deliveries in Q4 - which is the equivalent of an entire year’s production in 2020. Musk remarked on the call that they expect 20-30% growth in car production for next year, while Cybertruck has already become the third best selling EV in the US (trailing only the Y and 3).

Even more importantly, further details where shared on Teslas Robotaxi plans. FSD V13 is on its way, consolidating the entire software stack (highway and city streets) into one, with interventions expected to drop by 5-6x. By the end of Q2 next year, FSD will statistically be safer on the road than a human. That is the magic moment we have been waiting for.

Another incredible thing shared was that Tesla has secretly been operating an autonomous ride hauling service for employees only in California. The app concept that Tesla revealed in the Q2 earnings report turned out to be real and already in use. For now, Tesla are legally required to operate the service with a back-up human pilot in the front seat, but this is expected to change within long. Finally, Musk reassured vehicle owners that if the company is unable to pull off unsupervised Full Self Driving using Hardware 3, owners will receive a free upgrade to Hardware 4 (now called AI4).

So much good was shared in the report and the call that it is hard to summarize, but Semi demand also remains strong, while there is no news on the long-awaited Roadster. The stock now trades around the $250 level again.

Unity continues the refresh

In other good news, my sole struggling holding, Unity (U) is continuing its leadership refresh. After new CEO Matthew Bromberg came a board, he has let go of the few remaining C-level executives, that still remained following Jim Whitehurst’s initial purge. They have now started to rehire and it was announced on October 30th that Steve Collins will join the company as its new CTO.

The CTO role at Unity has been shrouded in a bit of mystique ever since one of its founding Danish members, Joachim Ante, stepped down from the role he had held for nearly 20 years. But by first impressions, Collins seems like just the right fit. He has decades of experience, having served:

As CTO of King, the makers of Candy Crush, owned by Activision-Blizzard, and now Microsoft (MSFT)

As CTO of Havok, a highly esteemed physics engine of the 2000s, still in use today, now also part of Microsoft.

As CTO of Swrve, a real-time marketing automation cloud platform for mobile.

He likewise brings relevant experience from academics, as the founder of the computer graphics research group at Trinity College, Dublin and having launched its Masters in computer game technology. What an incredible track record. I am fully onboard with this pick.

Later the same day, it was also revealed that Alex Blum, Senior VP of Corporate Development had been promoted to COO. This guy I am not so familiar with, but I am glad to see someone rising from within the company also. Judging from this rather damning article that I recently stumbled upon, Bromberg and Whitehurst still have a lot of work cut out for them - and will need to be able to dearly trust whoever ends up responsible for the mess of the acquisition of ironSource.

Thanks for reading - It is good to be back!

See you next month as we hope for a good outcome of the US election. I remain optimistic that the people of America will make the right decision and fight for their own integrity. If I was a betting man, my money would be on Harris.

Watch List

Changes to the Watch List

Removed Tapestry (TPR) as my interest in the stock was tied to its acquisition offer for Capri (CPRI) which in October was definitively blocked by regulators. Elkem (ELK) moved from Top Pick to Watching, as I have become aware of unfavorable taxation on Norwegian stocks, Otis (OTIS) also moved from Top Pick to Under Consideration and Meta (META) upgraded to a new Top Pick.

About

My Watch List sorts stock by sector and notes are included for each one, describing my interest and reservations. The status indicates the likelihood of a position being added to my portfolio. ‘Watching’ means I just keep an eye on them, whereas ‘Top Pick’ means they are very likely to find their way into my portfolio at one point - ‘Under consideration' means somewhere in between, with notes offering some elaborating thoughts. Please note my Watch List is based on my own research and goals and is in no way a recommendation of what to buy.

| Sector | Name (Ticker) | Status | Notes |

|---|---|---|---|

| Healthcare | Gubra (GUBRA) | Under consideration | Hidden gem, versatile, familiar, though unprofitable |

| Merck & Co (MRK) | Watching | Casual interest, limited familiarity | |

| Medtronic (MDT) | Watching | Casual interest, limited familiarity, attractive dividend | |

| Industrials/Manufacturing | DSV (DSV) | Watching | Interesting strategic M&A expansion, great execution, automation opportunity |

| Elkem (ELK) | Watching | Cyclical industry, but well positioned to break out | |

| Otis (OTIS) | Under consideration | Potential dividend growth play, familiar | |

| Norsk Hydro (NHY) | Watching | Casual interest, limited familiarity, attractive dividend | |

| Lockheed Martin (LMT) | Watching | Ethical concerns, too expensive | |

| Corning (CLW) | Watching | Weakening moat, rising competition, familiar | |

| Consumer | McDonalds (MCD) | Watching | Strong brand, limited optionality |

| LVMH Moët Hennessy Louis Vuitton (MOH) | Under consideration | Strong leadership, performance, too expensive | |

| Coca-Cola (KO) | Under consideration | Strong brand, stable giant, too concentrated, familiar | |

| PepsiCo (PEP) | Under consideration | Strong brand, well diversified, familiar | |

| Sea (SE) | Top Pick | Core business weakening, innovator, just turned profitable | |

| Grab (GRAB) | Watching | Great business synergies, interesting market, unprofitable | |

| DoorDash (DASH) | Watching | Automation opportunity, strong marketshare, unprofitable | |

| Energy/Utilities | Ørsted (ORSTED) | Top Pick | Strong positioning, leadership, familiar |

| NextEra energy (NEE) | Watching | Strong position, too concentrated, too expensive | |

| Technology | Palantir (PLTR) | Top Pick | Amazing tech, highly dilutive, opaque |

| Meta (META) | Top Pick | Strong leadership and userbase, undergoing big change | |

| Mercado Libre (MELI) | Watching | Great execution, growing market, too expensive | |

| Shopify (SHOP) | Watching | Innovator, well positioned, unprofitable | |

| Xiaomi (1810) | Watching | Fast innovator, China risk, previously owned | |

| Nvidia (NVDA) | Watching | Strong brand and leadership, too expensive, previously owned | |

| Finance | Coinbase (COIN) | Under consideration | Strong brand and leadership, unprofitable, previously owned |

| BlackRock (BLK) | Under consideration | Strong execution, exposed to the economy, attractive dividend | |

| SoFi Technologies (SOFI) | Watching | Strong leadership, innovator, unprofitable | |

| NuBank (NU) | Watching | Great execution, interesting market opportunity | |

| JP Morgan Chase (JP) | Watching | Stable giant, overlapping industry with holding | |

| Manulife Financial (MFC) | Watching | Stable giant, attractive dividend, limited familiarity |

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.